Savings AccountMoney Market AccountMutual FundLiquidityYou can take your money from a savings account at any time. But you're restricted to six transfers or withdrawals per calendar month/ statement cycle. ATM withdrawals don't count toward this limit.You may withdraw from this account at any time. But you're limited to six transfers or withdrawals per calendar month/ statement cycle. "Free" checking accounts don't charge you a monthly fee or have a minimum balance requirement to open the account. Bankrate's 2020 checking and ATM survey found that 47 percent of checking accounts at larger banks are free.

They are far more common at community banks and credit unions. Banks and credit unions offering free checking accounts will still charge for things like overdrafts, which can easily cost $30 or more. We looked at the fees charged by 10 banks across 16 no interest checking accounts and 15 high yield checking accounts. Almost all of these banks charge monthly maintenance fees for checking accounts, but in most cases, these fees can be waived if certain conditions are met. These conditions typically require a minimum daily or average balance or a monthly direct deposit of a specific amount. Some of the accounts listed below are only available in specific states.

1 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month. Your limit will be displayed to you within the Chime mobile app. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions.

It's becoming increasingly difficult to find truly free checking accounts. At many banks, you're now required to pay a monthly maintenance fee for the privilege of keeping your checking account open. Such fees can range from a few dollars to $20 or more, depending on the bank and other associated perks. However, you do not have to attend one of the affiliated schools to open a U.S. And there are several appealing reasons to do so, starting with the $0 monthly maintenance fee it offers and the U.S.

Bank ATMs, mobile check deposit, and payments with Zelle. You also get the ATM fee waived for your first four non-U.S. Bank ATM transactions per statement period, and your first order of checks is free. Virtually all banks and credit unions offer checking accounts. Checking accounts are typically easy to set up with a small deposit.

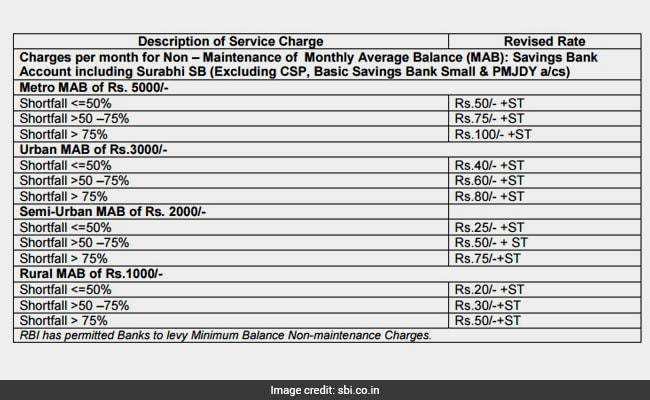

If they earn interest at all, it tends to be less than savings and money market accounts. APYs , account minimums and whether you'd have to pay a monthly service fee are some of the most important things to look at before choosing a savings account. A savings account that charges fees likely isn't the right account for you. But many online banks offer high-yield savings accounts that don't require you maintain a minimum balance. Savings accounts that offer a competitive yield and don't require a minimum balance or charge a maintenance fee are a good fit for any type of saver. In recent years banks have expanded their checking account services to include online and mobile banking.

With checking accounts, there's no limit to how often you can access your money. Unlike savings accounts, you can withdraw, transfer, write checks and make debit card charges as often as you'd like. BlueVine Business Checking has no monthly fees, no minimum opening deposit and no minimum balance requirements.

This free online business checking account includes unlimited transactions, plus it allows you to earn 1% interest on your account balance up to $100,000. You aren't required to enroll in overdraft protection. We have two overdraft solutions to help customers maintain a positive balance and avoid overdraft fees or returned checks. You can set up your accounts to auto transfer funds from another AbbyBank account to cover an overdraft, such as auto transferring funds from a savings account to your checking account. You can apply for an Overdraft Protection loan which will transfer funds from the loan to cover an overdraft. The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month.

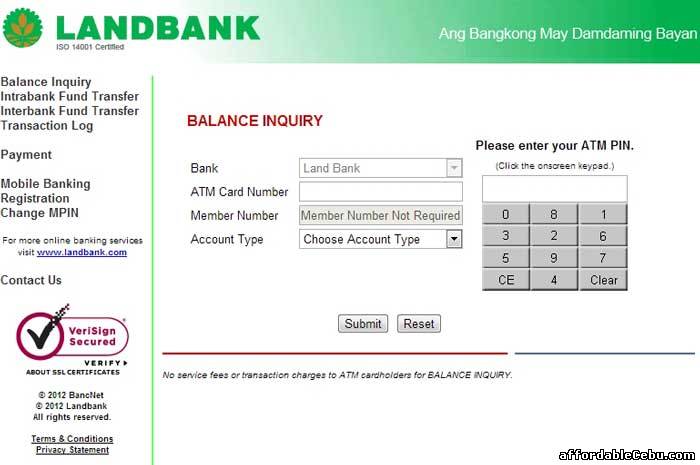

And customers have access to an extensive ATM network. The savings account pays a competitive rate and Discover offers a suite of other products and services. This bank has no monthly fees or minimum balance requirements for its checking or savings products.

Customers have access to an extensive ATM network and automatic savings tools. You may even receive your paycheck up to two days early with direct deposit. Look for business checking accounts that have no monthly service fees and no minimum balance requirements. And pay close attention to the fine print — some accounts are free only if you maintain a daily or monthly minimum balance or can meet another qualification to waive the service fee. The Axos Basic Business Checking account has no monthly maintenance fees but requires a minimum deposit of $1,000 to open the account. This online business checking account includes 200 fee-free transactions per month, 30 cents per transaction after that.

Our FREE mobile app and online banking features let you do your banking on your schedule. You can pay your bills automatically, deposit checks online – even pay other people from the convenience of your computer or mobile device. Set balance alerts, and easily transfer funds between accounts, so you never have to worry about paying an overdraft fee. You can even use the FREE CardValet®1 app to turn your debit card on and off, set transaction controls and receive alerts when your debit card is used. Therefore, you can deposit some money at a later date after opening the account.

Moreover, the checking account has no minimum balance requirement meaning that you can have any amount in your bank account. Generally, Bank5 Connect offers a winning combination of attractive rates and low minimum deposit requirements across its products. It requires only $10 to open a savings or checking account and a relatively easy-to-meet $500 minimum deposit requirement to open a CD. There are no monthly maintenance fees on any of its accounts.

Quontic Bank offers a cash rewards checking account that pays up to 1.50% cash back on qualifying debit card transactions each statement cycle. The bank also offers a separate high interest checking account that pays up to 1.01% APY so long as certain monthly requirements are met. And Ally offers consistently competitive rates on its products with low fees and no monthly maintenance fees or minimum balance requirements. It has an extensive ATM network and it reimburses up to $10 per statement cycle for fees charged out-of-network ATMs. Checking accounts, like savings and money market accounts, at Federal Deposit Insurance Corporation banks are insured up to at least $250,000. The National Credit Union Share Insurance Fund , administered by the National Credit Union Administration at its credit unions, insures individual accounts up to $250,000.

Money that's within FDIC insurance limits and guidelines is safe even if an FDIC bank fails. Use the FDIC's Electronic Deposit Insurance Estimator or the Share Insurance Estimator to calculate your coverage. Confirming coverage with the FDIC or NCUA and your bank is always the best practice. FDIC-insured online banks are every bit as safe as brick-and-mortar banks up to that limit.

Plus, digital banks often don't charge monthly service fees and pay higher yields. The FDIC's BankFind tool makes it easy to confirm an online bank is FDIC-insured since it allows you to search by web address. Kabbage Checking is a simple, affordable banking option for small-business owners. The online business checking account has no monthly fee, no minimum opening deposit requirement and no minimum balance requirement. NBKC's Business Account is a free business checking account with no deposit and no minimum balance requirement. This account includes unlimited transactions, fee-free ATM access through the MoneyPass network and up to $12 in monthly refunds for ATM fees charged by other banks worldwide.

To find the best savings accounts, our editorial team analyzed annual percentage yield , minimum balance requirements, monthly fees and requirements to avoid monthly fees. The Lili Account is a free checking account designed for freelancers, side hustlers, and solo professionals. That's a rare find in a banking industry rife with mediocrity. Our checking accounts have all the convenience your lifestyle demands. Enjoy fast, friendly service with easy access to your money. Several bank accounts have no minimums to open and no balance requirements.

We make every day checking easy with the best online and mobile options so you can pay your bills and loans online, anywhere, anytime. Varo does not require you to have a minimum balance when opening your bank account. Furthermore, the bank does not charge monthly fees nor overdraft fees for your checking account. Once you open an account with Varo, you will get a free Visa debit card that you can use in over 55 locations for free. With no minimum deposit, no monthly fee, no direct deposit requirements, it's inexpensive to keep your funds in this account.

Also, BB&T waives the fee associated with non-BB&T ATM transactions two times per statement cycle, although you will not be reimbursed for the other bank's fee. Though the account is fee-free, overdraft fees tend to be high, although you can opt-out of Overdraft Review to avoid them. At some banks, you're able to open a bank account online without making an initial deposit. Make sure the bank doesn't require a minimum balance to avoid paying a maintenance fee.

It's possible that you could incur a monthly service fee by not opening the account with enough money. Bankrate's 2020 checking account and ATM fee study found that 47 percent of non-interest bearing accounts don't charge monthly service fees and don't impose balance requirements. The majority of non-interest accounts will waive fees under certain conditions, such as direct deposit.

Challenger banks, a term used to denote upstart banks like Chime and Current, also offer no-fee accounts. The Novo business checking account has no monthly fees, no minimum balance requirements, no ACH transfer fees and no incoming wire fees. This free business checking account also includes unlimited transactions and refunds on all ATM fees worldwide. Even before you look at the APY offered on a savings account, make sure you have enough money to open the account and can maintain the minimum balance requirement . Even if it's a high-yielding account, monthly maintenance fees can cause you to lose interest earnings or even some of your principal.

If you are looking for a low-risk way to save money over a long period of time, high yield savings accounts may be a good option for you. Banks that offer online savings accounts tend to have higher rates for a better return on your deposited funds, as long as you can follow any minimum balance and monthly fee rules. Keep in mind that savings rates are subject to change over time.

Drawbacks include high fees for replacement debit cards, high minimum balance requirements for the best annual yields, and no out-of-network ATM fee reimbursements. Making purchases or withdrawals from your savings account isn't as easy as doing it from your checking account. Unlike checking accounts, savings accounts typically won't come with a debit card for you to make point-of-sale transactions in person or online, for example.

Not many online banks offer checking, money market accounts, savings and CDs. But Discover Bank offers all four and has competitive products in each category. It also offers a competitive yield on its savings account. Discover Bank might be for you if you want your checking and savings at the same online bank.

Chime is a mobile-first banking app that merges the low cost of online checking and savings accounts with the convenience of truly on-the-go banking. The headline here is Chime's promise – subject to the policies of payers and their banks – that its Deposit Account customers get paid two days faster with direct deposit. If you're accustomed to Friday paydays but could really use the money on Wednesday, the Chime Deposit Account may be the free checking account you've been waiting for. If you're looking to minimize fees, you might want to consider an online checking account.

Many of online checking accounts are interest bearing, have no monthly maintenance fees and have low rates for other fees. These accounts are ideal for individuals who don't need access to brick-and-mortar banking branches and who don't write checks frequently. Banks provide this service to cover purchases that you can't pay for due to a too-low account balance.

But signing up for overdraft protection may not be a great idea. Sure, you won't have to pay a NSF fee and the bank will cover the funds, sparing you the embarrassment of watching your debit card be declined. But you'll get hit with a fee, commonly around $33.47 per item overdrawn, according to Bankrate's 2020 checking account and ATM fee study. Before you choose an interest-bearing checking account, pay attention to the requirements you must meet to earn the highest yield. You may need to set up direct deposit, enroll in eStatements and/or make a certain number of debit card purchases each month. All three of these business checking accounts have no monthly fees, no minimum deposit requirements and allow you to open an account online.

If you overdraw your account, Capital One offers the ability to opt-in to Next Day Grace, which allows the bank to authorize transactions that exceed the balance in your account. You'll have until the end of the next business day to make your balance positive, or you'll incur a $35 fee. Any bounced paper checks will incur a $9 fee, regardless of overdraft coverage. Discover Bank has no minimum balance requirements and boasts a pretty forgiving fee schedule with no bill pay, NSF, check reorder, replacement debit card, or bank check fees. Plus, customers have fee-free access to more than 60,000 ATMs around the U.S. – more than most competitors.

2Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required. Message and data rates may apply, check with your wireless carrier. Must have a bank account in the U.S. to use Send Money with Zelle®.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. The bank will need to verify your identity using a valid ID and Tax ID #. We will ask for your name, address, phone, and Social Security numbers as well as your birthdate, driver's license or picture ID and employer. We will verify this information though the major credit reporting agencies. Your credit score may be a factor in determining your eligibility for opening the account and an indicator into how you would handle a checking account.

Student bank accounts offer a low-fee option for high school and college students. The lack of monthly fees, the low minimum deposit requirements, and the offers to waive specific fees all help new account-holders learn the ropes of money management inexpensively. Having a student bank account allows students to keep their focus on their classes rather than jumping through banking hoops to keep their money safe.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.